Turnover vs revenue: Definitions & differences explained

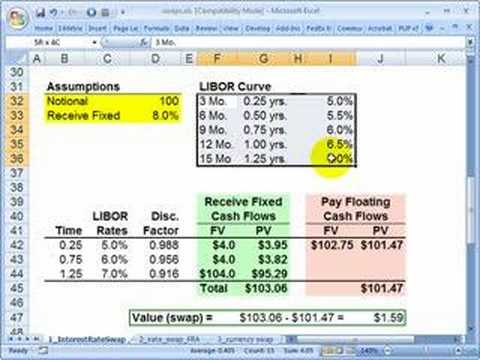

For instance, if a computer manufacturer sells 400,000 $1,000 computers, their gross operating profit will be $400 million. This company’s total revenue would be $410 if they had also earned $500,000 in interest and sold $10 million worth of assets. If a company has stable sales revenue through multiple periods and a decreasing cash turnover ratio, this is often a bad sign. Essentially, the information indicates a company must spend more cash to generate the same revenue each period.

Technically, net sales refer to revenue minus any returns of purchased merchandise. On the other hand, the UK’s Generally Accepted Accounting Principles (GAAP) defines revenue in a broader view. This means that the software company generated $440,000 in revenue over the course of the year.

What Is Accounts Receivable Turnover?

In business terminology, it means the total value received from the sale of goods, the supply of services or both by the company during a particular financial year. It may also mean the total value of business, a firm does, in a particular period. Turnover is a broad term which is used in different contexts in different disciplines. In general, it implies the business or trading done by a company, in terms of money, in a given period. On the other hand, the word revenue is specific in nature, which refers to the proceeds received by the company in a particular period. It is not the profit of the company, rather it is the receipts of the company.

Hong Kong’s Texwinca Holdings revenue at HK$6,059 mn in FY23 – Fibre2fashion.com

Hong Kong’s Texwinca Holdings revenue at HK$6,059 mn in FY23.

Posted: Tue, 20 Jun 2023 10:37:23 GMT [source]

Working capital represents the difference between a company’s current assets and current liabilities. Similarly, accounts payable turnover (sales divided by average payables) is a short-term liquidity measure that measures the rate at which a company pays back its suppliers and vendors. It is essential to understand and calculate revenue since it helps companies determine their growth and sustainability. It’s also a performance metric for comparing the current financial year with previous periods.

Related Differences

In economic theory, revenue refers to the number of units a business sells. It can also be the number of customers multiplied by its price for the goods and services. Examining the quantity of units sold is another way to determine inventory turnover. revenue vs turnover The distinctions between turnover and income are numerous and complex, yet they are critical for companies to exist. All businesses want to enhance and maximize their income, and comparing year-to-year performance helps assess growth and progress.

- Turnover rate – Businesses may use turnover rate to measure their efficiency in managing corporate resources, which is useful for planning and regulating output levels.

- This stability makes revenue a more reliable metric for businesses to use when making long-term strategic decisions.

- That number indicates whether a business is actually growing or contracting.

- As such, it isn’t always the same—even for companies within the same industry.

Revenue is the company’s income by selling goods and services to its customers for a price. The words turnover and revenue are often used in each other’s place, and often they even mean the same. However, an organization can even generate revenue without having a turnover.

Difference Between Turnover & Revenue

Conversely, net income is revenue minus all expenses, including operating expenses and nonoperating expenses, such as taxes. Nevertheless, both revenue and operating income are essential in analyzing whether a company is performing well. The most common uses of this concept are looking at the accounts receivable and inventories ratios. However, in different fields such as accounting, business, human resource management, etc., the word can have varied terminologies but usually means the same thing.

Scottish firm targets trebling of revenues to more than £100m ‘in few years’ – Yahoo News UK

Scottish firm targets trebling of revenues to more than £100m ‘in few years’.

Posted: Tue, 20 Jun 2023 03:30:00 GMT [source]

The actively managed portfolio should generate more trading costs, which reduces the rate of return on the portfolio. Investment funds with excessive turnover are often considered to be low quality. Government agencies also sell goods or services, from drilling permits to auctions of seized property. The proceeds from these activities are seldom referred to as government sales.

Can Income Be Higher Than Revenue?

Revenue is simply the income generated by any organization by selling their goods and services at a particular to ensure profit. The revenue gives the gross income of the company, from which the costs are deducted to give the company’s net income. Most businesses use turnover and revenue interchangeably as they may both mean the total income or sales at a given period. Yes, companies can treat them as synonyms without problems as the two terms share similar ideas. Turnover is an accounting term that measures how rapidly a company runs its activities.

This means that turnover can fluctuate quite significantly from one period to the next, While revenue tends to be more stable. This stability makes revenue a more reliable metric for businesses to use when making long-term strategic decisions. Turnover is a term that is used in business to describe the process of selling products or services. It can also be used to describe the act of exchanging one thing for another. For example, if a company sells its products for cash, this is considered turnover.

Turnover vs Revenue: What Are the Differences?

By contrast, turnover can refer to how quickly a company either has sold its inventory or is collecting payments compared with sales over a specific time period. Generally speaking, turnover looks at the speed and efficiency of a company’s operations. When you sell inventory, the balance is moved to the cost of sales, which is an expense account.

- Revenue is the amount of money earned by a company from its normal business operations, which are often the sales of goods and services to customers.

- Operating income helps investors separate out the earnings for the company’s operating performance by excluding interest and taxes.

- Turnover and revenue are both important for businesses and organizations since they assess and signal success during the fiscal year.

- Examples include salaries and benefits, factory equipment (depreciation and maintenance), rent, and certain utilities.

- 1to1 Accountants breaks traditional accounting methods by introducing fast, effective and innovative accounting techniques to organise your business and deliver customer excellence.

- This means that the software company generated $440,000 in revenue over the course of the year.

Other non-operating revenue gains may come from occasional events, such as investment windfalls, money awarded through litigation, interest, royalties, and fees. Revenues must be reported in the income statement, which is available to shareholders. Furthermore, calculating turnover ratios and putting them in financial statements assists shareholders in better understanding them. Another key difference between turnover and revenue is that turnover reflects activity within a specific accounting period, while revenue can be earned in different accounting periods.